Conquer Your Cash Flow

with virtual accounting, bookkeeping, tax, and finance for small businesses

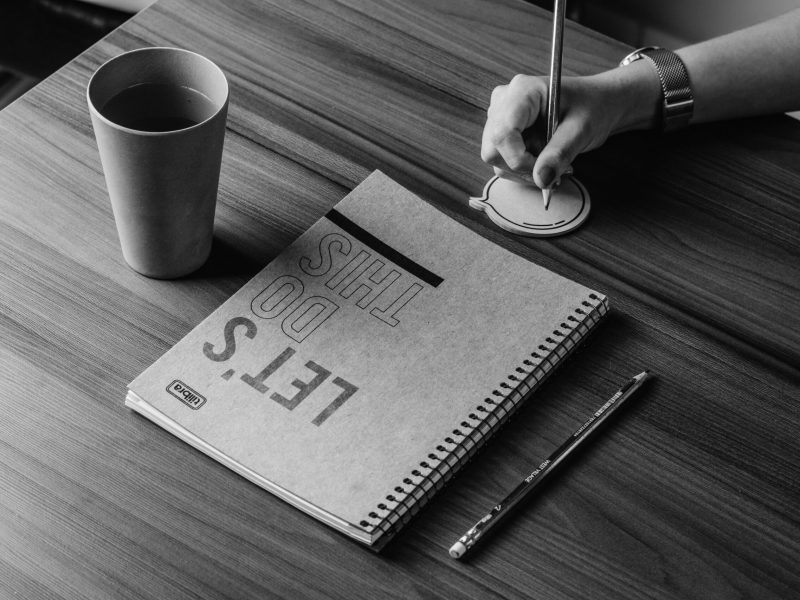

Build the business you've always wanted.

Let us handle the finances.

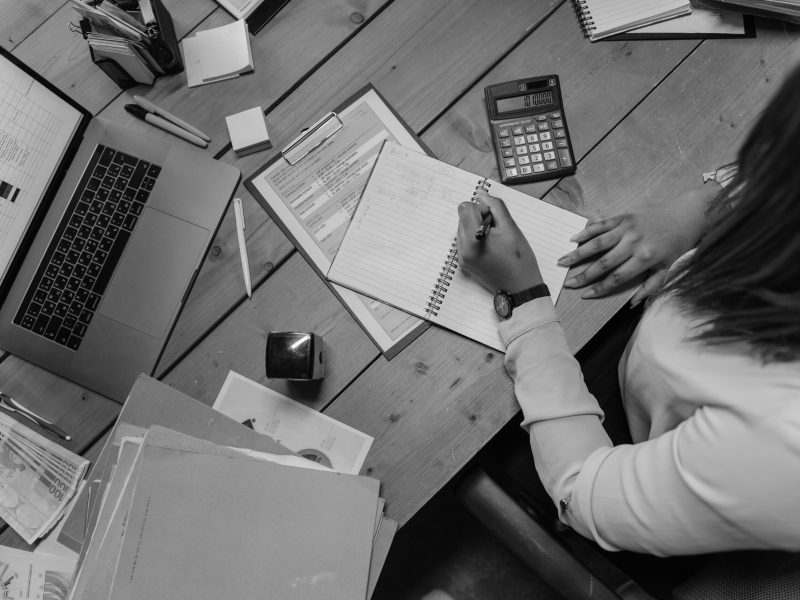

Accounting & Bookkeeping

Establish a foundation for good financial fitness

Tax Strategy & Filing

Build on clean books with money-saving tax strategy

Virtual CFO

Create exponential company value with strategic financial planning

What Clients Say

To say the difference in QuickBooks Online knowledge and DAILY financial position of the company has significantly improved is a huge understatement. Red Bike Advisors has eliminated any question of where the company stands financially at any given moment.

"When we got a notice from the IRS, Richard and the Red Bike Advisors tax resolution team were right there to help us navigate it. The IRS said we owed around $40,000 in unpaid taxes and penalties, but Red Bike Advisors was able to negotiate that amount down to $1,000."

The Red Bike Advisors team is so collaborative. They don't treat me like a transaction, but like a partner. This is a firm I can depend on.

Flat Fees, No Surprises. Just Exponential Value.

powering your financial success.

Whatever sticky financial situation you’re facing–a letter from the IRS, unpaid back taxes, state payroll issues–our Tax Resolution team is here to help.

Whether you’re dealing with a business partner or divorce dispute or getting your books “exit ready,” our forensic accounting team is here to help.

Breakaway from Business Finances Stress

How financially fit is your company? Take the "Financial Fitness" checkup and stay ahead of of the pack.

You deserve a thriving, successful business. Let’s see if we can help.

Book a free strategy session with Red Bike Advisors.