Take the Surprise and the Stress out of Taxes

Start proactively planning and save strategically on taxes.

Ah, taxes. Such a special time of year, when you send several gigabytes’ worth of documents to your tax preparer and brace yourself for the bad news on how much you owe (or worse, try to labor through those time-sucking tax forms yourself). Any of this sound familiar?

Communication Black Hole

Why won't my tax provider answer my calls and emails till January?

Cash Panic

Do I have enough cash to cover the tax bill this quarter?

CPA Sticker Shock

When you ask your accountant a quick question and get a giant bill after.

Lost in Translation

What’s my tax advisor saying anyway? I don’t understand these acronyms.

Tax FOMO

What tax breaks am I missing and don’t know to ask about?

Don’t let the tax code scare you; make it work for you.

The tax laws are overly complex, burden America’s taxpayers, and negatively impact voluntary compliance. This is especially problematic … for small business taxpayers.

So what separates businesses that win the tax game from those that lose?

Introducing Red Bike Advisors Tax Strategy & Filing Services

Planning & Advisory

With annual strategic tax planning sessions and year-round ad-hoc support, you’ll never be left waiting till April to talk to your accountant and understand your tax liability.

Preparation, Filing & Representation

Our Tax Packages include planning, advising, preparation and filing for your business and family. And should you need taxing authority representation in case of an audit, we’ve got you.

Breakaway Business Tax Packages

Customize your service package with add-on services including virtual CFO and bookkeeping & accounting services.

Plans Built for Small and Growing Businesses

Tax Essentials

Worry-free tax compliance and strategic savings.

Starting at

$440/month

Billed monthly

Ideal for new and small businesses with up to $1M revenue

Tax Strategy:

- Financial statement reviews for tax issues and opportunities

- Proactive annual tax planning & quarterly projections

- Ad-hoc digital conversations and/or meetings on tax strategy, not to exceed 2 hours/quarter

Preparation & Filings:

- 1 Federal business + 1 Federal individual return

- 1 State business + 1 State individual return

- Preparation of quarterly tax estimates

Tax Standard

Worry-free tax compliance, strategic savings, and specialized services.

Starting at

$800/month

Ideal for growing companies with $1M+ revenue

Tax Strategy:

- Financial statement reviews for tax issues and opportunities

- Proactive annual tax planning & quarterly projections

- Scenario planning

- As-needed email conversations and/or meetings on tax strategy

- Special project work e.g. S Corp reasonable salary analysis, pass-through entity tax election, and change in accounting method

Preparation & Filings:

- 1 Federal business + 1 Federal individual return

- 1 State business + 1 State individual return

- Preparation of quarterly tax estimates

*Average pricing is listed to give you an idea of the investment in a strategic tax partner like Red Bike Advisors. Final pricing is customized for you based on your unique tax needs, plus any optional add-ons. We’ll customize your plan during your free strategy session.

Each Plan Includes

- Proactive annual tax planning session

- Review of financial statements for tax issues and opportunities

- Quarterly tax planning, estimations, and recommendations

- Scenario planning: 1 scenario

- Year-end tax management opportunities

- Compliance with changing federal, state, and local laws

Optional Add-Ons

- Sales and income tax nexus assessments

- Past return reviews: correct mistakes, prevent future errors

- S Corp reasonable salary analysis

- UNICAP compliance

- Change in accounting method filing

- Other ad-hoc or complex tax compliance service

- Taxing authority representation (tax controversy and resolution)

- Accounting & Bookkeeping services

- Virtual CFO services

- Fraud & forensic services

- M&A financial due diligence

Who are Red Bike Advisors Tax Strategy & Filing Services for?

- Small businesses that want to play the tax game and win with strategic moves that save money and help you plan correctly

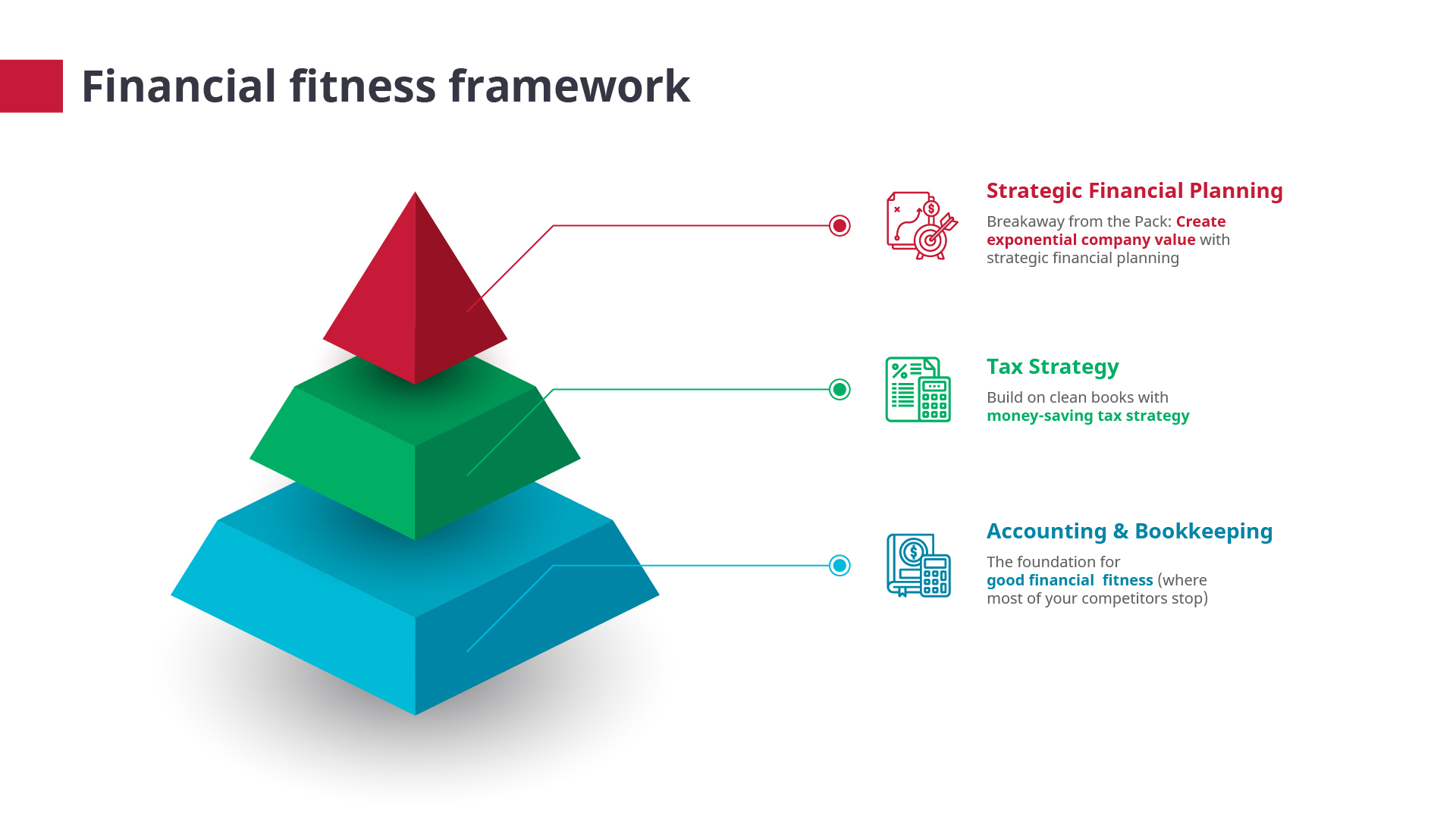

- Proactive, growth-focused companies that understand the firepower of combining strategic financial planning, tax strategy, and foundational bookkeeping & accounting services is the key to exponential growth

A True Investment

Red Bike Advisors Tax Strategy & Filing Services aren’t a cost center, but a “sleep well at night” center.

Do It Yourself | Traditional Accountant | Red Bike Advisors |

|

| Tax Strategy & Filing Services

Average annual investment: $7,500

Peace of Mind: Priceless! |

Planning

Strategic tax planning sessions with your Red Bike Tax Advisor team to optimize tax savings and estimate quarterly liability

Advisory

Year-round ad-hoc support and consulting from your Red Bike Tax Advisor team

Prep & Filing

On-time preparation and filing of federal and state tax returns for your business and family

Representation

Taxing authority representation in case of an audit (tax controversy and resolution)

What Clients Say

The Red Bike Advisors team is so collaborative. They don't treat me like a transaction, but like a partner. This is a firm I can depend on.